Let's Get Connected

Fill out our short questionnaire to see

if we are a good fit!

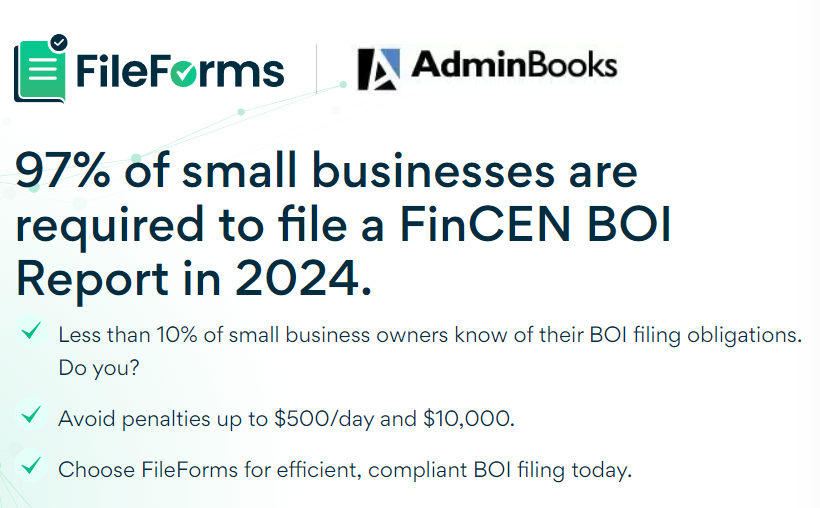

Beneficial Ownership Information Reporting

Beneficial Ownership Information Reporting

Who must file?

Most corporations, LLCs, and limited partnerships will likely need to file a BOI report, but some business structures are exempt. Click the link below to complete a free questionnaire to determine if your company is required to file.

Who is a beneficial owner?

- Anyone who possesses or exercises control over twenty-five percent or more of the voting stock or equivalent of the company is also considered a beneficial owner.

- Any individual who, directly or indirectly, can exercise substantial influence over the reporting firm is considered a “beneficial owner.” Chief Executive Officer, President, and General Counsel are all examples of such high-ranking personnel.

Current Court Ruling:

As of January 23, 2025, the requirement to file has been reinstated however FinCEN has not established a deadline.

To stay on top of the very frequent BOI updates, subscribe to our newsletter today!

Recent Blog Articles

January 20, 2025

The recent wildfires in Los Angeles County have devastated communities, leaving thousands dealing with property loss, displacement, and financial uncertainty. In response, both the IRS and the State of California have granted tax deadline extensions and financial relief to help individuals and businesses recover.

©

2001 -

©

2001 -

AdminBooks TM, Inc. All Rights Reserved.

Site created by

Tafgraphics Design Studio, Inc.

Tafgraphics Design Studio, Inc.