Fill out our short questionnaire to see

if we are a good fit!

CORPORATION SET-UP

INCORPORATING YOUR BUSINESS

PDF Resources:

Which entity is best for you?

Are you in compliance with your Corporate Minutes?

While AdminBooks does NOT provide legal advice on the liability of a corporation, we can assist the client in the administrative process in setting up a corporation.

Some of the benefits of being incorporated are:

- Tax savings

- Asset protection

- Losses pass to the owner's individual tax return (S-Corp)

- Fringe benefits

- Audit protection

- Raise capital

After getting counsel for your specific situation, AdminBooks can help you...

- Reserve a Corporate Name

-

Prepare Articles of Incorporation

-

File Articles of Incorporation

-

Obtain California Corporation Number

-

File SS4 Form to obtain an EIN

-

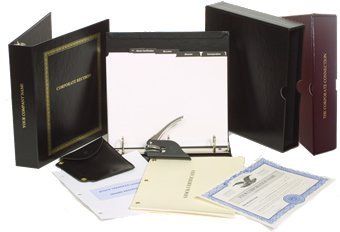

Provide a Corporation Binder

-

Prepare Bylaws

-

Prepare Waiver of Notice & Consent

-

Prepare Stock Notice & Register Stock

-

Prepare and File 2553 Form for S-Election

-

Prepare Statement of Information

-

Prepare First Corporate Minutes

- Quarterly Meetings to insure compliance

"I chose AdminBooks to do my corporate minutes because they are the best at what they do. I could not run a successful business without them. Thank you all at AdminBooks for taking care of me."

- Peter Weiss,

The Backflow Guy

Frequently Asked Questions:

All corporations start as a C-corp and pay tax at the corporate level. A C-corp becomes an S-corp by completing the 2553 federal form. An S-corp pays tax on the net income and "pass-through" to the owners personal tax return. There are advantages of staying as a C-corp and other advantages to move to an S-corp. Consult a professional to see which entity is better for your specific situation.

It is not required to use an attorney to incorporate, except in South Carolina. In all other states, you can file the articles of incorporation yourself. However, if you are unsure of what steps to take or don't have the time to research it yourself, a professional is often well worth the money and grief.

We suggest that you take some time in coming up with a name. It must not be similar to another name already formed. Write it out, say it out loud, poll your closes associates to ensure you are good with the company name.

We will request that you give us your top 3 choices for names and we will check these to confirm they are available with the State. Unique names usually have no issues of being rejected and having to use alternatives.

Most states allow for one person to act as shareholder, director and all officers.

An EIN is an Employer Identification Number. Yes, it is required for your new corporation. You will need a federal EIN and a State EIN in order to process payroll, which all officers are required to be on payroll.

Recent Blog Articles

Tafgraphics Design Studio, Inc.