Fill out our short questionnaire to see

if we are a good fit!

So, what exactly are “business miles?” I can answer this by telling you what it is NOT. Business miles do not include your commute to and from work. They don’t mean driving a few miles down the road to eat at your favorite taqueria for your lunch break. Lastly, they don’t include going the extra 4 miles out of the way to pick up a coffee before you meet with your next client. Business miles are strictly driving for business purposes only. This can look like driving from your office to meet a client in the field or your boss asking you to run to the store to pick up materials for your job site. To sum it up, anything done for personal use will not count as business miles.

Start tracking those business miles so you can get reimbursed, whether you are an employee driving your personal vehicle for company purposes or a business owner using either a personal or business vehicle! There are a few ways you can track your mileage EASILY. Then, of course, there is our favorite way (AdminBooks approved!)

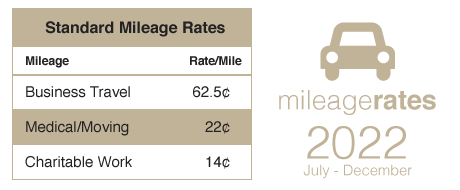

Hypothetically, when you leave your office to meet a client, take note of what your odometer says before leaving and what it says when you arrive at your destination. Repeat the same process if you are going back to the office or to another client’s location. Do NOT track if you are leaving and going home; driving home is commuting miles which is not deductible! The IRS requires beginning and ending odometer, date and business purpose. You will need to submit the number of business miles driven from Jan to June and then a separate number of miles from July to December to either get reimbursed from your employer or if you own a business, it will be deducted on your taxes.

Another option I have heard people do is simply taking photos of their odometer in the same fashion as taking notes, before leaving and upon arrival. Many do this because it is faster than jotting down the long odometer number. The problem with this method is that photos can easily get jumbled up, especially if you are using a personal phone and are an avid picture taker! If you choose this method, I would suggest pairing it with a daily, end-of-day tally to keep track of the daily miles in one place.

Apps are a great way to quickly, easily and effectively track your miles. There are quite a few apps available for this, with each having its own unique features. Some honorable mentions include Everlance, Stride and TripLog. Out of all apps available, MileIQ wins the top spot for us. This app will constantly run in the background of your phone so it automatically tracks any drive you do without you having to initiate the drive! Simply go into the app, and swipe right if it was a business drive or swipe left if it was a personal drive. The free version offers 40 drives a month. It doesn’t stop recording once you hit 40. Just go in and clean up your log (differentiating between business and personal, deleting the personal trips). The drives recorded after that 40 marker will appear. If you think you drive more than 40 business trips a month, the app offers a paid version ($5.99) that can accommodate more drives. We love MileIQ because it does most of the work for you and can provide you with accurate reports whenever you need them!

PS – We recommend writing down your odometer reading on December 31 at a minimum. Why? If audited by the IRS, you will be able to go back and reconstruct your mileage log in more detail. Receipts from auto mechanic or oil change service centers also document your odometer reading. Make sure you save those receipts!

For more useful tips or questions on tax changes contact us directly!