Fill out our short questionnaire to see

if we are a good fit!

But, be careful. Business travel deductions are an area the IRS will focus frequently on because many taxpayers aren’t familiar with the rules. Figuring these deductions can be complicated. Below are some of the top travel questions asked by taxpayers. Consult your tax preparer for your specific situation or review IRS Publication 463.

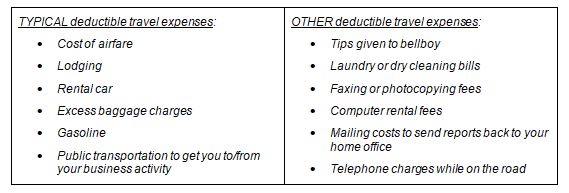

So what business travel expenses can you deduct?

The Internal Revenue Service defines travel expenses, for tax purposes, as “the ordinary and necessary expenses of traveling away from home for your business, profession or job.” The rules about what is considered a business travel expense are not black and white, so there is some room for interpretation.

How do you decide if a travel day is personal or business?

Whether a trip is primarily business or personal depends on the facts and circumstances. The amount of time spent on personal activities compared to the amount of time spent on activities directly relating to business is an important factor in determining whether the trip is primarily business or personal.

If your trip is largely for personal reasons, but you conduct business while away, you may deduct only those expenses that are directly related to business.

You can deduct all of your travel expenses if your trip was entirely business related. If your trip is primarily for business but also includes some personal travel, you can deduct only the travel expenses related to business.

What classifies as a business day?

Generally, a business day is at least four hours and one minute to be considered a business day.

Days spent traveling to and from a business destination are considered business days. Weekends and holidays are considered business days if they fall between business days. For example: You travel from San Francisco to Jamaica for business meetings, beginning on Tuesday and concluding on Wednesday of the following week. You treat Saturday and Sunday as business days, even if you spend those days at the beach. On the other hand, if the meetings concluded on Friday and you spent the weekend on the beach, you count those days as personal, nondeductible days.

If your presence is required at a particular place for a specific and bona fide business purpose, that day is a business day, regardless of time spent on business. For example: You live in San Francisco but need to travel to Washington, DC, personally to sign a contract. The contract signing takes 30 minutes. The day is a business day.

You also have a business day if you travel to a business location with the intent to conduct business but could not conduct that business because of circumstances beyond your control. For example: you travel to Disney World to attend a seminar. The seminar leader is struck ill and no seminar is held. You go to Epcot for the day. The day is a business day. (Your Epcot ticket is not deductible if you do not separately qualify it for an entertainment deduction, but the rest of your expenses for food and lodging qualify as business deductions because your return flight is the next day.

Here is an example of fitting in personal travel with a business trip. You work in Atlanta and take a business trip to New Orleans. On your way home, you stop in Mobile to visit your parents. You spend $1,996 for the 9 days you are away from home for travel, meals, lodging and other travel expenses. If you had not stopped in Mobile, you would have been gone only 6 days and your total cost would have been $1,696. You can deduct $1,696 for your trip, including the cost of round-trip transportation to and from New Orleans.

Why is classifying a day as a business day important?

Can I pay family or friends for business lodging?

Yes, deduction for business travel lodging expenses when staying with a relative or friend for less than 15 days is deductible to the business. For example, will you be taking a business travel trip to a city where your mom and dad live? If so, you could pay fair rent for staying at their home and the rent you pay mom and dad could be tax-free to them.

1. You need to pay a commercial (fair) rent to mom and dad.

Can I deduct travel for my spouse?

Travel expenses can be deducted for a spouse (or person accompanying the taxpayer) if:

You can still take your spouse on the trip even if they are not an employee, but the expenses related to their travel are NOT deductible.

How can I deduct international travel?

All expenses for travel outside the U.S. are deductible if the trip is entirely devoted to business activities. If the reason for the trip is primarily for non-business reasons, such as a vacation, NONE of the travel costs are deductible. If the primary purpose of the trip is for business, but some time is spent on personal activities, travel costs generally must be prorated by dividing the number of business days by the total number of travel days. But, even if time is spent on non-business activities, the trip is considered entirely for business if one of the following conditions is met:

Cruise Ship Conventions

You can deduct up to $2000 per person per year if you take a cruise and there is a business convention held. The seminar must be directly related to the taxpayers trade or business and the ship must be a US ship and all the ports traveled are within the U.S.

If the expenses listed on your receipt show for meals or entertainment, the deduction is only 50%. However, if the expenses are not stated separately, the cost is 100% deductible.

Actual costs Versus Per Diem

In some situations, it is more advantageous to take advantage of using the IRS’ per diem rates for your travel expenses. These are IRS published rates for meals, travel and lodging by area (See IRS Publication 1542 ). For example, if you find that you don’t spend much on meals, the per diem rate might get you a higher deduction per day than taking actual costs. If you file your tax return as a proprietor or as a corporation in which you own more than 10 percent, you may not use the per diem allowance for lodging, actual receipts are required.

Needed Proof of Travel

In every case, it’s important to remember to always keep your receipts so that you are able to justify an expense should you ever get audited. Taxpayers are required to maintain a diary, log trip sheet or similar records, as well as documentary evidence (for example, receipts, canceled checks) to substantiate the amount, time, place and business purpose of the expenditures. For travel and entertainment expenses (other than lodging), receipts are not required for expenses below $75. However, your credibility increases if you have all documentation of your trip. It is also important to keep books, brochures, or handouts for conferences attended. Records must be kept showing the time, place, business purposes and amount of each separate expenses.

As you can see, travel deductions can be confusing. If you have a specific travel situation you would like to discuss, call Admin Books for assistance.