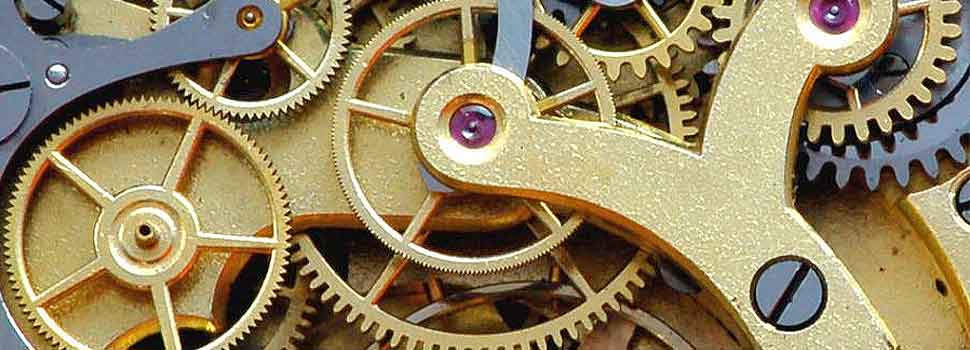

Clockwork: Design Your Business to Run Itself

What does clockwork mean? Clockwork is a mechanism with a spring and tooth gear wheels. Clockwork in business is the mechanism of having a process that runs smoothly, easily, and repeatedly.

I recently read a book by Mike Michalowicz called “Clockwork: Design Your Business to Run Itself.” Mike is also the author of “Profit First.” I have heard him speak many times and in May 2018 had a short, quiet conversation in person with him when he told me about a book he was writing. Pick up the book, or better yet, download the audible version, which is fantastic because it shows off his personality.

Owning your own business is exciting and fun! Yep, that’s not the whole truth. Owning a business is also difficult; there are long hours, challenges, sacrifices, and it can be draining emotionally and financially. Mike provides fresh ideas and good reminders of specific things that a business owner can implement in their business to make it run more efficiently and effectively.

Mike lays out a seven step plan:

1. Analyze the 4D mix

2. Declare the corporate queen bee role

3. Protect and serve the queen bee role

4. Catcher systems

5. Balance the team

6. Make the commitment

7. Become a clockwork business

Step One

As a business owner, you need to step away from doing all the work and focus more on designing the flow of your business.

There are four phases:

- doing the work

- deciding what and how the work gets done

- delegating the work

- designing the vision and flow of business

Take some time to figure out how much time you spend in each of these phases. What work can you delegate? What work keeps bouncing back to you to make decisions? The business owner needs to move more of their time from doing to designing . Then, analyze each employee’s time to make sure each person is working optimally.

Step Two

Every honey bee has two things to do. First, they must protect the queen bee. Once the queen is protected, the honey bee can do their primary job. The author encourages every business to identify the most important role. What is the one thing that is so important that the success of your company is dependent on it? In his book, Mike outlines a nine step process on how to determine what this is for your business.

Step Three

This step focuses on the process and delivering you’re most important service or “widget.” Imagine a circle which is the queen bee role. Then in your mind’s eye, I draw lines away from the circle which will represent tasks that are completed in your business. Mike suggests looking at each task to determine not only how long each task takes, but also which task is furthest away from the most important role. Once you have this mapped out, you can determine whether to trash the task, transfer the task, or trim the task down.

Do you have the most skilled people doing unskilled work? Consider a doctor…do they file papers or empty trash? No! Their job is to identify the medical issue and prescribe a course of action.

Step Four

Businesses either have none of their processes documented or they have thick, huge binders of endless pages printed out. Many of us are now out of date. How do you capture systems and keep them fresh and current? Mike recommends documenting the process using videos, which is like a “show and tell” rather than a written script.

Create the videos while you are training your next new employee. Store them in an online portal, organizing the folders by content. If you forgot to include anything on the video, have the new employee make the next video with the improvements.

When training employees, empower them to make their own decisions. Tell them, “We hired you because you are smart and driven. We hired you to find answers. Come back to me with your best answer and we will discuss it.” The only time to intervene is if you see them making a decision that will have extreme and dire consequences. Failure should be embraced and rewarded. The only true failure is in idleness.

Step Five

To have a business run like clockwork, you need to have the right people doing the right things, in the right portions, in the right way.

When to hire? The owner cannot do the work by him or herself. Would you rather make $50 an hour doing the work yourself or for $5 an hour doing no work at all into infinity?

Who to hire? You want to hire people with a great, get it done attitude. Someone with high energy, high intelligence who is a strong cultural fit and who has a desire to do the work.

So what is the issue? Business owners have a fear issue: they have a hard time trusting others to run the business. Hiring is like marriage. You need to date, spending time learning about each other.

Typically, there is usually a courtship season before people are married. The same should be true in business. In order for your company to run like clockwork, your team must be aligned and balanced. Everyone must understand your purpose and corporate mission. Mike’s purpose is to eradicate entrepreneurial poverty. AdminBooks has a mission to educate people with financial options that will make a difference in their business and in their life!

Step Six

Set a piece of paper outside in the sun and it will sit there unchanged. Take a magnifying glass and concentrate the sunlight on the paper and you will start a fire. All the power in the world is useless if it is not focused. In order to have your business run like clockwork, you need to concentrate on a commitment. Fill in the blanks: Our commitment is to serve (whom) by (how). In the spirit of Mike’s infectious personality, I challenge you to state your commitment out loud right now. Your business must have consistent delivery of your service offerings. It must be predictable and not waver in the process.

Who is your best client or customer? In the book, there is a story of a business owner named Gary. He identified his best client and said, “Give me a dozen of this type of client and my profits will skyrocket!” I have seen many businesses be more successful when they are very clear on who they serve.

Step Seven

In order to know the health, the owner needs to have a watchful eye on a dashboard that shows metrics of how the company is doing. If the company is inefficient, it will be in one of 4 areas.

1. Attract - The company must attract prospects.

2. Convert - Leads mean nothing until there is a sale.

3. Deliver - If you cannot deliver, he will not stay in business.

4. Collect - If you do not get paid, the company will be in trouble.

This is the ACDC method of watching the business.

If you have a bottleneck, the solution is to work on one step at a time. If you try to tweak multiple things at once, you may cause additional problems.

In November 2018, I had an atypical schedule where I was traveling for five weeks straight. I flew to Nashville to speak to a group of business owners. Then, I attended a QuickBooks conference to speak to accountants. My oldest son, Andrew, got married out of town. Finally I flew to Texas to sit on a Tax Council.

Was I nervous about being out of the office that long? Of course!

Many times I felt disconnected. Did the office and team run perfectly? Absolutely not! The best thing was I realized I trusted my team to implement the process we have in place to provide clients with the utmost of care. They all are rock stars! While we are constantly innovating our processes, the firm is running like clockwork!