Fill out our short questionnaire to see

if we are a good fit!

Personal Representative

Under state law, a personal representative is the person appointed by a court to administer an estate. The term includes both executors (appointed when decedent has a will) and administrators (appointed in the absence of a will.) A personal representative nominated in a will has no authority over estate assets unless appointed by a court.

Duties of Personal Representative

Duties include the collection of the decedent’s property, paying any creditors, and distributing assets to beneficiaries. In addition, the representative is responsible for filing various tax returns and seeing that the taxes owed are properly paid.

No Court-Appointed Representative

When there is no probate and no appointed representative, the IRS will allow a “person charged with property of the decedent” to file the decedent’s income tax returns and claim refunds. IRS written guidance does not specify who this person should be. If there is a surviving spouse, he or she usually files a joint final Form 1040 and any other required returns. If there is no surviving spouse, the person who files is commonly:

• The trustee of the decedent’s revocable trust,

• The personal representative nominated in the will who would have been appointed if probate was required, or a beneficiary receiving non-probate assets who undertakes the work.

The IRS uses the term “personal representative” to refer to anyone filing for a decedent, regardless of court appointment.

Decedent’s Tax Returns

The personal representative is responsible for the following returns when required:

• Form 1040, Final return for year of death--gross income of a decedent from January 1 until the date of death is reported on the decedent’s final income tax return.

• Form 1041, Income tax returns for the probate estate--required if income greater than $600 is received by the decedent’s estate after death.

• Form 706, Estate tax return--required if decedent’s estate exceeds the estate tax exclusion ($5,490,000 in 2017) or if portability election is made.

• Form 709, Gift tax for year of death--required if the decedent gave more than the annual exclusion ($14,000 for 2017) to any one person in the year of death or failed to file any prior year gift tax returns.

• Returns not filed by decedent for prior years—If a decedent is delinquent in filing their tax returns for prior years, their personal representative may need to complete the applicable forms for the outstanding years, which could include Form 1040, Form 1040X, Form 709.

• State income tax and estate tax returns -- Some states do not have an estate tax, but several states have annual estate tax exclusions that are significantly less than the federal exclusion.

A personal representative may be personally liable for unpaid tax if he or she distributed assets, the estate is insolvent as a result, and the personal representative had notice of the tax claim.

Application for Employer Identification Number (EIN)

An executor should obtain an EIN for the probate estate as soon as possible. The identification number must be included on estate returns, statements, and other documents. The executor can obtain an EIN immediately by phone at 800-829-4933 or at www.irs.gov by searching “EIN online.”

Note: The processing time for an EIN application by mail is four weeks.

Notice of Fiduciary Relationship

The personal representative must notify the IRS of the fiduciary relationship. Form 56 can be used for this purpose. File separate forms for the decedent and estate. Form 56 can also be used to notify the IRS of a change in fiduciary or termination of fiduciary relationship.

Prompt Assessment

Form 4810 can be filed to shorten the statute of limitations for tax returns from three years to 18 months. File Form 4810 separately after the returns are filed. Prompt assessment can be requested for Forms 1041 and Form 1040, including returns filed by the decedent. Prompt assessment cannot be requested for federal estate tax.

Discharge From Personal Liability

Personal representatives can request discharge from personal liability for estate, gift, and income tax after returns are filed. The personal representative is discharged from personal liability nine months after receipt of the request by the IRS, unless notified of unpaid tax.

Fees

All personal representatives must include in their gross income any fees paid to them from an estate. Generally, a taxpayer is not in the trade or business of being an executor and will report these fees on line 21, Form 1040.

Income in the Year of Death

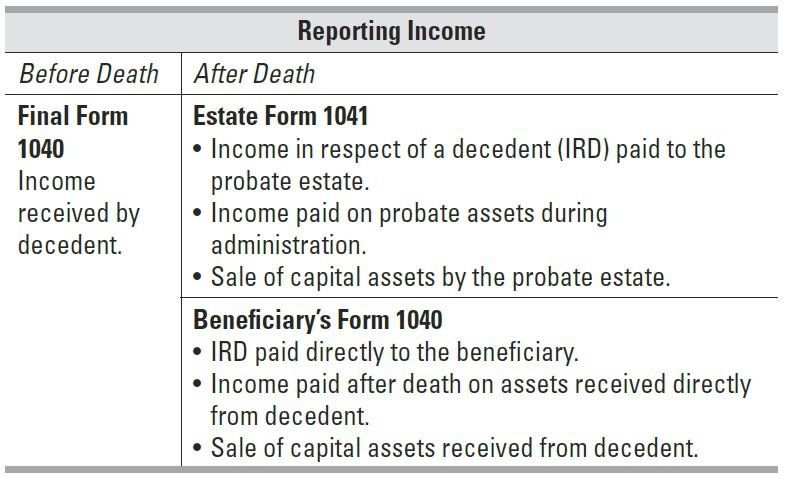

Report income actually or constructively received by the decedent before death on the final Form 1040. Report income received after death on the return of the recipient.

• Probate assets on Form 1041.

• Nonprobate assets on the tax return of the beneficiary, surviving joint tenant, or successor who received the asset.

Example: Gene died in 2017. His will leaves all his property to his wife, Kelly. Gene had the following assets:

• House, bank accounts, and vehicles owned jointly with Kelly.

• Brokerage account in Gene’s name alone.

• Life insurance and 401(k) that name Kelly as beneficiary.

• IRA that names Gene’s son, Emmett, as beneficiary.

• Unpaid wages.

Gene’s only probate assets are the brokerage account and unpaid wages. All other assets are paid to a surviving joint tenant or beneficiary and bypass probate. Income is reported as follows:

• All income received before death is reported on Gene’s final Form 1040.

• After-death earnings on the brokerage account and the wages paid to the estate are reported on Form 1041. If brokerage assets are sold during probate, the sales are reported on the estate’s Form 1041.

• Emmett reports taxable income from the IRA on his Form 1040 in years he receives distributions.

• Kelly reports taxable income on all other assets on her Form 1040 in the year she receives the income.

AdminBooks, Inc. 125 Lindo Lane, Morgan Hill, CA 95037 P: 408-782-9640 | F: 888-459-1117 | support@adminbooks.com | www.adminbooks.com