Estimated Tax Payments Guide

In the realm of personal and business finance, understanding and effectively managing estimated tax payments is crucial. This article aims to provide a clear and comprehensive overview of what estimated tax payments are, who needs to make them, and how to calculate and submit these payments efficiently.

What are Estimated Tax Payments?

Estimated tax payments are periodic advance payments of income tax that individuals and businesses are expected to pay if their income is not subject to sufficient withholding tax. This typically includes earnings from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes, and awards. Essentially, if you anticipate owing tax of $1,000 or more when your return is filed, you should be making estimated tax payments.

Who Should Pay Estimated Taxes?

- Self-Employed Individuals: This includes freelancers, independent contractors, and small business owners.

- Investors: Those earning significant income from dividends, interest, or capital gains.

- Retirees: Particularly those receiving substantial income from investments or retirement accounts not subject to withholding.

- Individuals with Multiple Sources of Income: Such as those with substantial side gigs in addition to their regular employment.

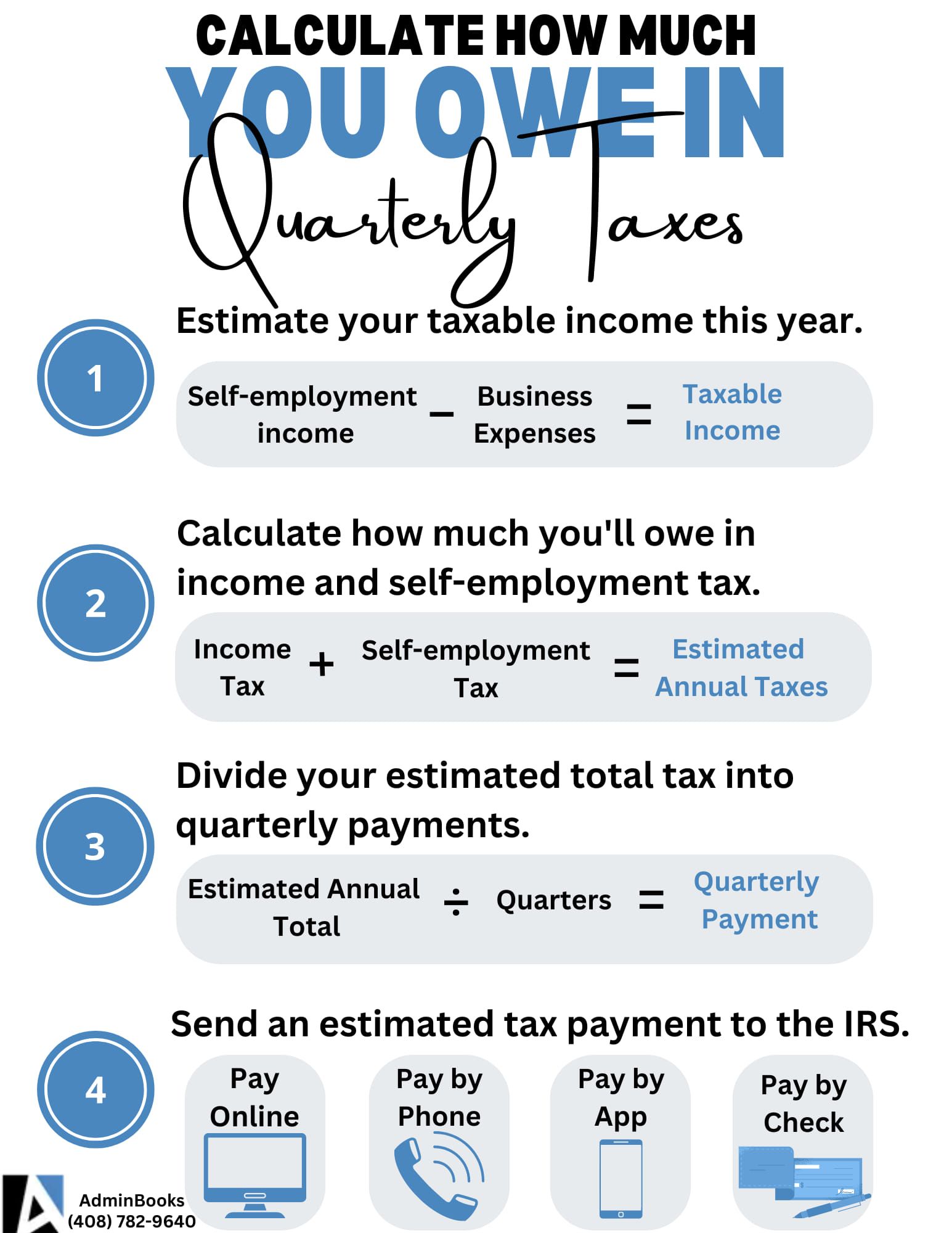

Calculating Estimated Tax Payments (see below for easy visual guide)

- Determine Expected Adjusted Gross Income (AGI): This includes all expected income for the year, deductions, and credits.

- Calculate Estimated Tax Liability: Using current tax rates and brackets, estimate the total tax liability for the year.

- Subtract Withholding and Credits: Subtract any taxes that are withheld from your regular employment or other sources and any applicable credits.

- Divide the Result: The remaining amount is your estimated tax, which should be divided into four equal payments.

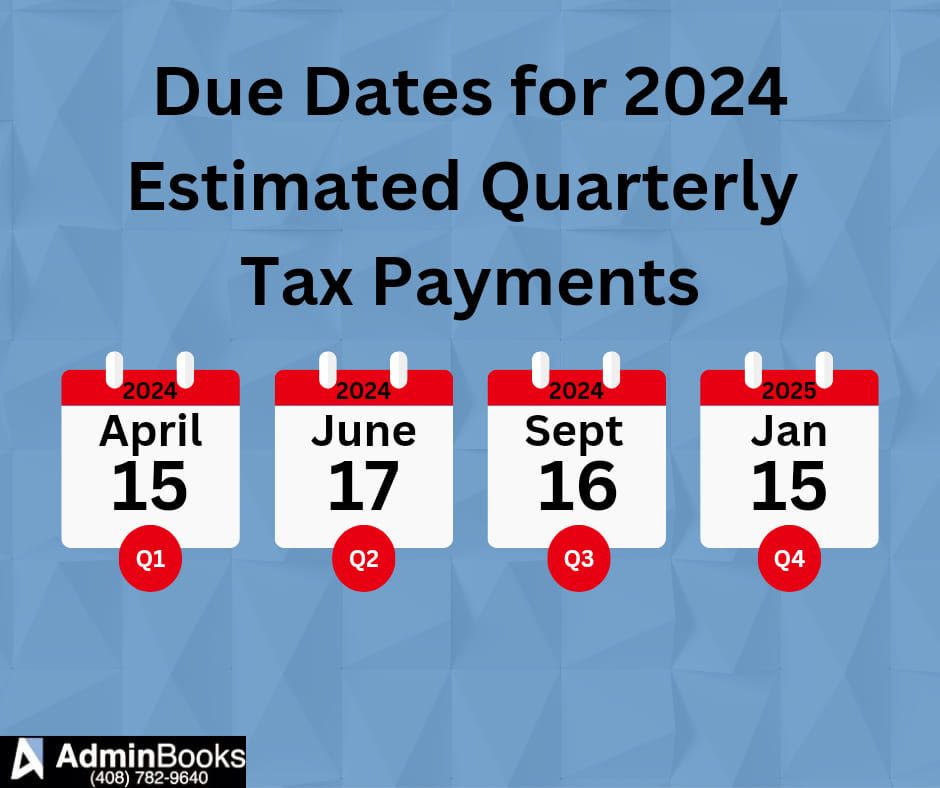

Schedules and Methods of Quarterly Tax Payments

Estimated tax payments are typically due in four equal installments. For 2024, the deadlines are April 15, June 17, September 16, and January 15 of the following year. Payments can be made via mail, phone, or online through the IRS website or the Electronic Federal Tax Payment System (EFTPS).

Penalties for Underpayment

Failing to make estimated tax payments can result in penalties. The IRS calculates penalties based on current interest rates and applies them from the due date of the estimated payment to the date of actual payment.

Tips for Managing Estimated Tax Payments

- Stay Organized: Keep accurate records of all income and expenses.

- Adjust Payments as Needed: If your income changes significantly, re-calculate your estimated taxes to avoid underpayment or overpayment.

- Use Electronic Payments: Utilizing online payment systems ensures timely and secure transactions.

- Consult with a Tax Professional: Especially if your financial situation is complex.

Managing estimated tax payments is a vital aspect of financial planning for individuals and businesses with diverse or significant non-wage incomes. Staying informed and proactive in estimating and paying taxes not only keeps you compliant with tax laws but also helps avoid unexpected financial burdens at tax time. Remember, when in doubt, consulting a tax professional is always a wise decision to ensure accuracy and compliance.