Free to Focus: A Total Productivity System to Achieve More by Doing Less

If you are a business owner, your mind is always running. There’s always a new idea to consider or a problem to solve. We have 168 hours per week but it never feels like enough. Yet we press on while our family, friends, sleep, and exercise get pushed to the bottom of the list. My summary on Michael Hyatt's book "Free to Focus" will explain 9 ways to WIN at work.

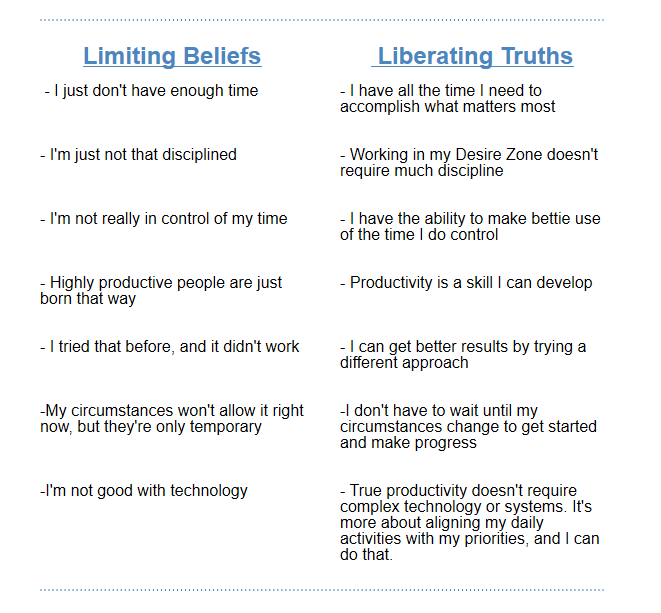

Michael Hyatt starts his book off by saying, “I think I’m having a heart attack!“ He was overwhelmed and stressed, realizing something must change. Long hours of work were depriving his health, relationships, and personal pursuits. And his pace was not sustainable. He came to realize that he must focus on the right

things.

In his book, Free to Focus, Michael shares nine ways to win at work.

Step 1: STOP

1. Formulate

what you want out of productivity. In order to be successful we must be productive. But we need time off for rest, family, leisure, and health. We need time when we are not thinking about work at all. We need the freedom to be spontaneous or the freedom to do nothing. Amazing things happen when you start focusing on what you do best and eliminate or delegate the rest. Ask yourself how many hours you want to work, including nights and weekends. Have a clear picture on what you want your life to look like.

|

|

Step 2: CUT

4. Eliminate

anything that stands in your way. If you want to please people, you will find yourself saying yes to everyone. Why do we do that?

Perhaps it is avoiding conflict, not wanting to disappoint people, fear of missing out on opportunities, or lack of courage. If you are saying yes to one thing you are also saying no to something else.

Say no to new requests.

|

|

|

|

|

|

|

| |

| |

| |

|

|

|

|