Fill out our short questionnaire to see

if we are a good fit!

The new tax act establishes additional limitations on the deductibility of certain business meals and entertainment expenses. Under the act, entertainment expenses incurred or paid after Dec. 31, 2017 are nondeductible unless they fall under the specific exceptions in Code Section 274(e). One of those exceptions is for “expenses for recreation, social, or similar activities primarily for the benefit of the taxpayer’s employees, other than highly compensated employees” (e.g., office holiday parties are still deductible). Business meals provided for the convenience of the employer are now only 50% deductible, whereas before the act they were fully deductible. Barring further action by Congress, those meals will be nondeductible after 2025.

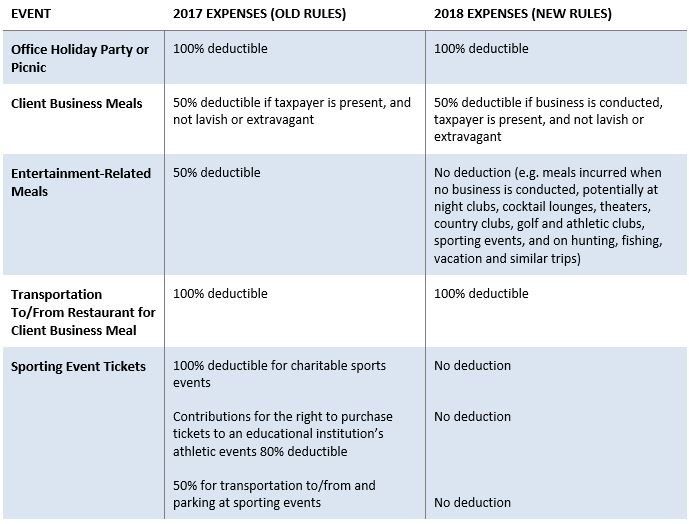

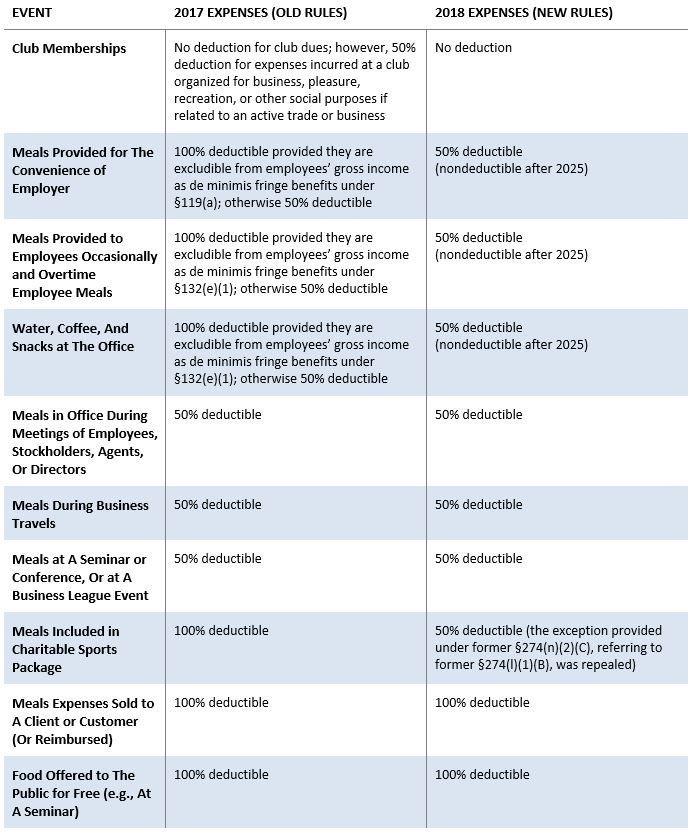

Businesses must continue to account for meals and entertainment expenses by classification in order to apply the appropriate limitation, with the addition of a new category in 2018 for “entertainment meals”. A comprehensive chart is provided below, to summarize proper treatment for many types of meals and entertainment expenditures, under the law applicable both before and after the act.

Under prior law, in order to deduct business meal and entertainment expenses, the expense must have been directly related to, or associated with the active conduct of a trade or business, or for the production or collection of income. Under the new rules this requirement essentially remains, though in a different form in that the rule now states that meals expenditures must be otherwise deductible (presumably in reference to §162). While the ordinary and necessary standards under §162 are sometimes difficult to apply in the context of meals expenditures, it is helpful to focus on the part of this standard that requires a deductible expenditure be incurred in carrying on business (§162(a); Mack v. Com’r, 35 TCM 1628, T.C. Memo 1976-359). On the other hand, this requirement is no longer applicable to entertainment expenses in that the deduction for entertainment expenses is repealed altogether. The repeal for entertainment expense deductions will also eliminate the deduction for meals, if the meal is entertainment-related.

Documentation is still required so that a taxpayer is able to prove:

·The amount of the expenditure

·The time, date and place of the expenditure

·The purpose of the business discussion

·The identification of the people who participated (§274(d), Reg. §1.274-5T(c)

Entertainment-related meals fall under the purview of entertainment expenses when the activity pertains to entertainment (in other words, the fact that an expenditure is a meal does not automatically escape the expenditure from the broader entertainment designation) (Reg. §1.274-2(b)(1)(l)). Because entertainment-related meals are now treated differently from client business meals, it may be necessary to establish new documentation procedures or information management systems in order to account for each separate category of meals. Under §274(k)(1), client business meals are deductible only if they are not lavish or extravagant, and only if the taxpayer is present with the client. Because §274(a)(1) now denies a deduction for an entertainment expenditure, it will be necessary to cause the activity at which the meal expense is incurred to not be entertainment-related. For instance, it is necessary to conduct business with the client to be otherwise deductible (§274(n)(1)), and the presence of substantial distractions might inhibit the business argument (e.g., meals expenses at night clubs, cocktail lounges, theaters, country clubs, gold and athletic clubs, sporting events, and on hunting, fishing, vacation and similar trips (Reg. §1.274-2(b)(1)(l))).

50% Deductible

The following expenses remain deductible subject to the 50% limit:

·Meal expenses for business meetings of employees, stockholders, agents, and directors. Office meetings and partner meetings fall into this category. If there is no business function to the meal, it is completely non-deductible for tax purposes. (§§274(e)(5), 274(n)(1))

·Generally, any meals during business travel. If a portion of a business trip can be considered personal and not related to the business function of the trip, then a portion of the meals expense should also be considered personal and not deductible. (§§162(a)(2), 274(n)(1)), Reg. §1.274-2(f)(2)(iv)(B))

·Meals at a convention, seminar, or any type of meeting even if the meals cost is not separately stated from the cost of the event. If not separately stated, it must be calculated by the taxpayer based on reasonableness or per diem rates for that location. (1986 TRA Bluebook, at 64 (1087); §§274(e)(6), 274(n)(1))

·Meals with people related to the business such as clients, customers and vendors provided that there is a business purpose or some benefit to the business will result, the taxpayer is present, and the amount is not lavish or extravagant. (§§ 274(k)(1), 274(n)(1), 162(a))

The following meals were previously 100% deductible but are now subject to the 50% limit:

·Meals provided on the employer’s premises to more than half of the employees for the convenience of the employer, and meals provided occasionally to employees or to employees to enable them to work late, work weekends, or otherwise work overtime (§§274(n)(1), 274(o)). Such meals generally satisfy the de minimis fringe benefit rules under §132(e)(1) or §119(a) and while such meals are nontaxable to the employees, such meal expenses provided as de minimis fringe benefits no longer are excepted from §274(n)(1).

·Office Snacks – coffee, soft drinks, bottled water, donuts and similar snacks or beverages provided to employees on the business premises. (§§274(n)(1), 274(o)). Such items generally satisfy the de minimis fringe benefit rules under §132(a)(4), but de minimis fringe benefits no longer are excepted from §274(n)(1).

·Meals provided as part of a package involving a charitable sports ticket (such amounts described under §274(l)(1)(B) are no longer excepted from §274(n)(1)).

100% Deductible

·Meal expenses for a company picnic or holiday party. (§§274(e)(4), 274(n)(2)(A))

·Food made available to the public for free – usually as part of a promotional campaign. (§§274(e)(7), 274(n)(2)(A))

·If the meals expense is included as taxable compensation to the employee or independent contractor and included on the W-2 or Form 1099, then the expense is fully deductible to the employer. (§§274(e)(2), 274(e)(9), 274(n)(2)(A))

·Meals expenses that are sold to a client or customer. (§§274(e)(8), 274(n)(2)(A))

Nondeductible Items

Unfortunately, some business expenses were and remain nondeductible and need to be categorized as such. Examples include:

·Lunch with customer, client or employee without a business purpose/discussion (§162(a))

·Club dues; for example, country clubs, golf and athletic clubs (§274(a)(3))

·Lavish or extravagant entertainment expenses (§274(k)(1))

Additionally, as noted above, entertainment expenses are now non-deductible as are meals associated with entertainment activities (§274(a)(1)). Expenses incurred at a club organized for business, pleasure, recreation, or other social purposes are now non-deductible as well, even if related to an active trade or business (§§274(a)(1), 274(a)(2), 274(a)(3)).