Melio - Simple Accounts Payable Application

Tired of writing and mailing checks? Tired of paying fees to pay bills electronically through your bank or other app? Ready to pay bills right from Quickbooks for ANYONE?If you answered yes, then the program Melio might be a great fit for your business!

Melio is an application that is embedded in Quickbooks Online and also works as a standalone software. Using Melio allows you to pay vendors by issuing an ACH payment or sending a paper check for FREE as long as you pay using your bank account. If you pay the bill using a credit card, the fee is 2.9%.

NO monthly subscriptions!

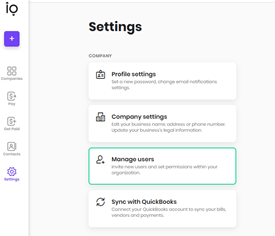

Setting up Melio is straightforward and well guided.

|

|

|

|

|

|

Using Melio-

Once your account is setup, you can utilize the features directly in Quickbooks Online to create a bill. When your QBO is linked with Melio, you will see in the bottom right corner the option to “save and schedule payment.”

|

|

Overall, Melio is a cost-effective method to electronic accounts payable.

You will save money on check stock, fees and headache.

They have a responsive support base

that can help with stop payments and technical questions.

If you have questions or would like to learn more, contact AdminBooks

for a customized setup consultation!

The Official Melio Paymentswebsite