Employee Retention Credit - Do You Qualify?

The Employee Retention Credit (ERC) is a fully refundable credit for businesses. The credit was initially created for COVID relief by the CARES Act in March 2020 but was limited to businesses that had not received PPP funds. The Consolidated Appropriations Act combined with the American Rescue Plan Act (ARPA) of 2021 have expanded the credit and made it more generous.

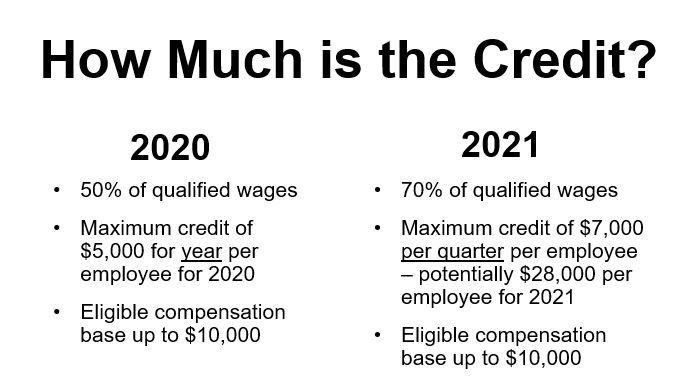

A business that received a PPP loan is now eligible to receive the credit. The original credit was 50% of eligible wages, limited to a refundable credit $5,000 per employee for the 2020. For 2021, the credit has been raised to 70% of eligible wages with a limit of $7,000 per employee per quarter. Meaning, since the credit has been extended to include wages paid through December 31, 2021, the refund potentially could be $28,000 per employee for 2021.

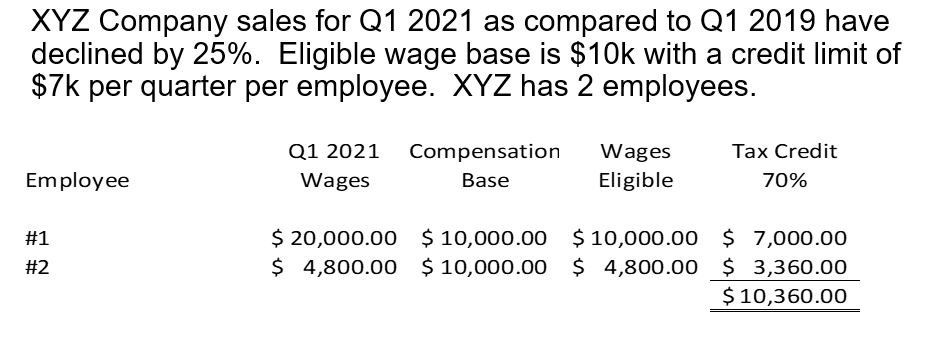

Here is an example of DECLINE IN RECEIPTS for 2020 vs 2021.

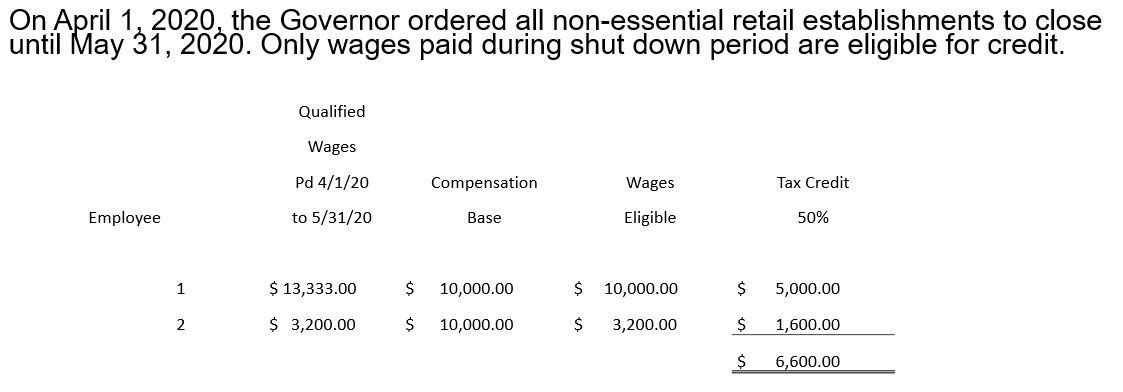

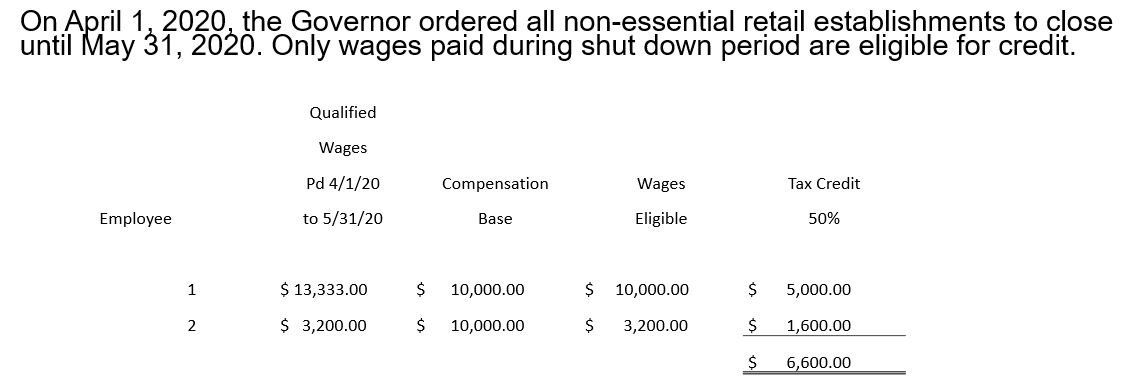

Here is an example of CLOSED BY GOVERNMENT ORDER for 2020.

Example of PARTIAL SUSPENSION OF BUSINESS:

The Diner is a full-service restaurant that also has a take-out business. By government order, indoor dining is suspended but the The Diner can still operate its take-out service. The full-service portion of the restaurant generates greater than 10% of the revenue and employee hours. It would qualify for the ERC for the time the business was not fully operating.

Need help with Employee Retention Credits?

support@adminbooks.com | 408-782-9640

AdminBooks is here to help you understand financinal relief options available to you and your business.

We can determine if you qualify for the Employee Retention Credits (ERC).