Let's Get Connected

Fill out our short questionnaire to see

if we are a good fit!

Who We Love to Work With/Who We Don't Love To Work With

We are not for everyone, but we might be right for you!

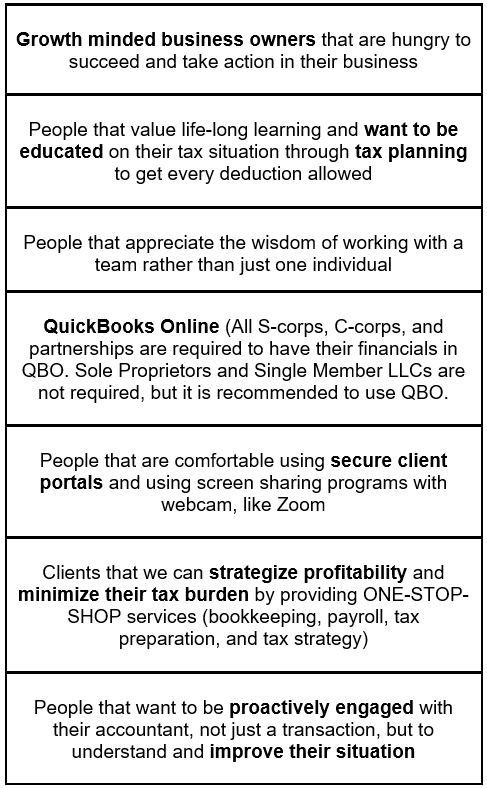

We LOVE to Work With...

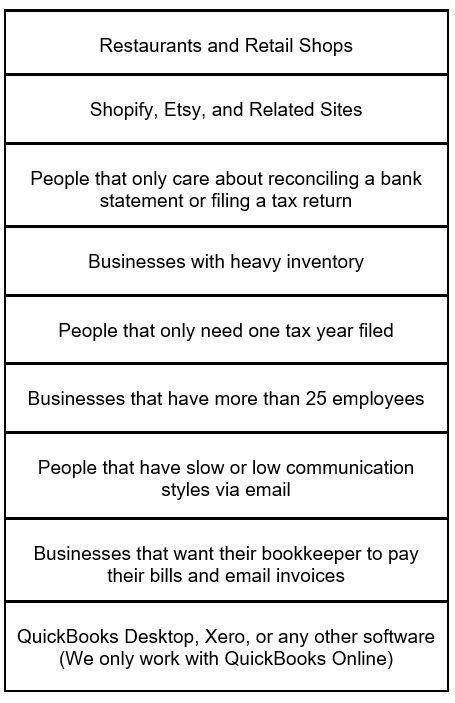

We DON'T Work With...

How We Conduct Business(And expect the same from our clients)

Honesty & Integrity--we will not post your daughter’s wedding expenses as a business expense!

No Mean People--we are kind and respectful to everyone & expect the same from those we work with!

Actively Engaged in Communication--we will communicate multiple ways, but expect that you will take action and be as invested in your situation as we are!

Speak with our expert to see if we are a good fit for you!

Recent Blog Articles

©

2001 -

©

2001 -

AdminBooks TM, Inc. All Rights Reserved.

Site created by

Tafgraphics Design Studio, Inc.

Tafgraphics Design Studio, Inc.