Student Loan Forgiveness Plan

What you have to do to claim the Student Debt Relief.

The U.S. Department of Education created a 3-part plan to help borrowers with student loans transition back to regular payments. The plan includes loan forgiveness of up to $20,000. You may be asking yourself what you have to do to claim this relief. Sign up at the Department of Education website by December 31st, 2023 to be notified when the process is opened and apply.

Part 1 –

Student loan payment pause extended through December 31st, 2022

If your loans are eligible, you do not need to do anything on your end.

There will be an automatic:

· Pause on loan payments

· 0% Interest rate

· Stopped collections

Make sure you have up-to-date contact information on your loan servicer’s website in your studentaid.gov profile.

You will be reminded when it is time for you to start making payments again.

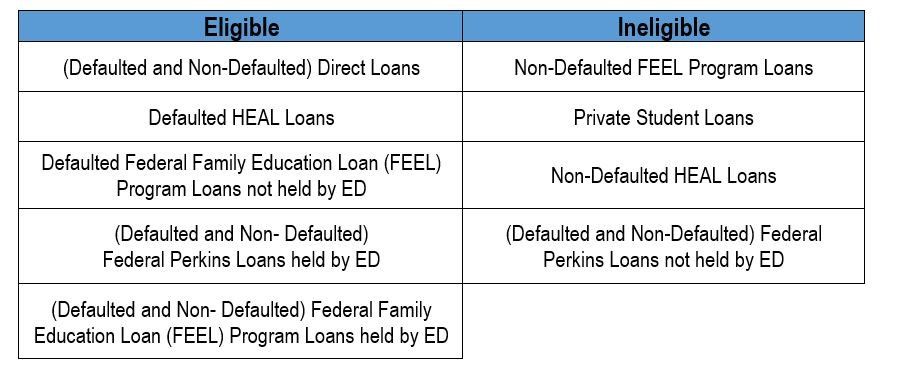

What loans are ineligible and eligible?

Your Loan Servicer can tell you if your loans are eligible.

How to contact them:

2) Find the “My Loan Servicers” section.

If you can’t log in, call 1-800-4-FED-AID (1-800-433-3243) for loan servicer information.

Part 2 -

The U.S. Department of Education will provide up to $20,000 in debt cancellation to loan borrows who received a Pell Grant. For non-Pell Grant borrowers, the amount will be up to $10,000. The loan borrowers individual income must be less than $125,000 or $250,000 for households to be eligible.

Borrowers who are employed by non-profits, military, federal, state, Tribal, or local government may be eligible to have all student loans forgiven. There are time-limited changes that waive certain eligibility criteria in the Public Service Loan Forgiveness (PSLF) program that expires on October 31, 2022. Click on the link for more requirement and eligibility information: PSLF.Gov

Part 3-

There is a proposed rule to create a new income-drive repayment plan. This will help substantially for lower- and middle-class borrowers and reduce monthly payments.

This rule will:

· Forgiveness for loan borrowers with less than a $12,000 balance

· As long as monthly payments are made, the borrower’s unpaid monthly interest will be covered, and the loan balance will not grow

· No borrower earning under 225% of the federal poverty level will need to make a monthly payment.

· Borrowers will not be required to pay more than 5% of their monthly income on undergraduate loans.

Questions:

How do you know if you are eligible?

Your annual income must be below $125,000 for individuals or $250,000 for couples or head of households.

If you meet the income limit, you will be eligible for up to $20,000 if you received a Pell Grant. If you did not receive a Pell Grant, the amount is $10,000.

Debt relief is capped at the amount of your outstanding balance due. For example, if you have a debt of $10,000, you will only receive that amount.

What do you need to receive loan forgiveness?

Borrowers may be eligible automatically because income date is already available to the U.S. Department of Education. If they do not have your income information, in early October there will be a simple application the Administration will launch. If you would like to get notification when the app is available, sign up on the Department of Education subscription website.

Once the application is completed, you should expect to receive the relief in 4-6 weeks. In order to receive relief before the payment pause date (expires December 31, 2022), borrowers should apply before November 15th, 2022.

What is the Public Service Loan Forgiveness Program (PSLF)?

This program forgives the remaining balance on your federal loans after 120 payments working full-time for local government, military, Tribal, federal, state, or a qualifying non-profit. Ending on October 31st, 2022, changes allow borrowers to receive credit for past periods of repayment that would typically not qualify for the Public Service Loan Forgiveness Program.

If you enroll on or after November 1st, 2022, you will not be eligible for this treatment. You are encouraged to sign up as soon as possible. Learn more on the PSLF.gov website.