Let's Get Connected

Fill out our short questionnaire to see

if we are a good fit!

Business Tips

BUSINESS TIPS

GOOD HABITS ARE GOOD FOR BUSINESS

Here are 21 helpful tips to follow:

- Keep all receipts. Make copies of thermal receipts that fade over time.

- Do not commingle personal and business expenses. Make sure you have separate bank and credit card accounts for personal and business.

- Meals are generally 50% deductible. Make sure you document who you ate with and what business you discussed. You must show intent to earn an income from the meal. The only time meals are 100% deductible is if you ask employees to work overtime, for coffee and water at the workplace, an occasional cocktail party or picnic, or a holiday gift of food. Having lunch or Starbucks by yourself is not deductible!

- Reconcile bank and credit card statements monthly. This will reduce the chances of forgotten transactions or transposition errors.

- Print out a Profit and Loss Detail Statement. Look over the deposits and expenses to verify that they are in the correct category.

- The IRS has strict rules requiring proving expenses in the following categories: home office, business gifts, car & truck, travel, meals and entertainment.

- Business gifts are limited to $25 per person per year. If you and your spouse both give gifts to the same person, you are jointly limited to $25. It does not matter whether you have separate businesses or an independent connection with the recipient. Small gifts of $4 or less are not included in the $25 limit. They can be imprinted items like pens or desk sets. There is no limit if the gift is given to a corporation.

- All officers of a corporation must be on payroll and receive W-2 wages. If an officer loans the company money, interest MUST be charged. There must be a written repayment plan.

- Remember, tax laws change annually and they can be complex. Always consult your CPA or Enrolled Agent for assistance, strategies and recommendations for your individual situation.

- Build a team around you that will provide the skills needed to succeed in business. Do not attempt to do it alone. Hire a bookkeeper, an administrative assistant, an attorney, marketing contractor, etc. Delegate!

- Do not wait until the end of the year to enter all the income and expenses for your business. If you do a little each month, tax season will not be stressful for you.

- Keep a log book in each vehicle to record business miles. Document date, beginning and ending odometer and the purpose of the trip.

- The following are NOT typically deductible: owner's draw, credit card payments, dry cleaning costs, federal tax payments, clothing, or your morning coffee! Seek advice.

- Corporations are required to keep annual minutes. Anyone can sue for any reason. Do not be lazy in completing your minutes. Keep your liability veil strong.

- Budgets are not a curse word. They allow you to know exactly what your costs are – do you know? Tell your money where to go, don't be reactive by not having a plan!

- Being able to read and understand financial statements is vital to the success of your business. If you are not sure what they mean, ASK and get informed. You cannot make wise decisions if you do not know your financial position.

- Do you know how the IRS determines if a person is an employee or independent contractor? Be careful on this. You will be subject to the highest penalties and interest if they find that you should have been paying someone as an employee, rather than a contractor. Do it right!!

- Do not skimp on the costs of furthering your education. It is important to keep your skills sharp to set you apart from your competition. Also, invest in your employees for their professional development!

- Be careful if you extend credit to your customers. Make sure your business will not fail due to their uncollectible invoices.

- Shoe boxes are for shoes, not for business records. It is important to have a clean, easy way of tracking your income and expenses -- those you owe money to and those who owe you money. This is not a luxury, but a necessity in order to make good business decisions.

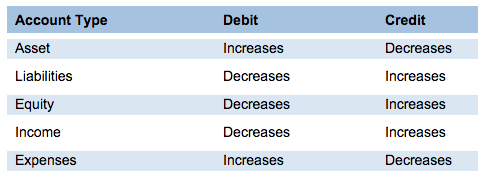

- It’s acceptable to have a cheat sheet for your debits and credits!

Are we the best bookkeeper for you and your business?

Recent Blog Articles

January 20, 2025

The recent wildfires in Los Angeles County have devastated communities, leaving thousands dealing with property loss, displacement, and financial uncertainty. In response, both the IRS and the State of California have granted tax deadline extensions and financial relief to help individuals and businesses recover.

January 7, 2025

The new year is here, and with it comes an important deadline for business owners: January 31, 2025. If you’ve paid independent contractors, service providers, or freelancers $600 or more in 2024, you may need to file a 1099 form for them. With the deadline just weeks away, now is the time to get organized. Filing your 1099s on time not only avoids penalties but also keeps your business in good standing.

©

2001 -

©

2001 -

AdminBooks TM, Inc. All Rights Reserved.

Site created by

Tafgraphics Design Studio, Inc.

Tafgraphics Design Studio, Inc.