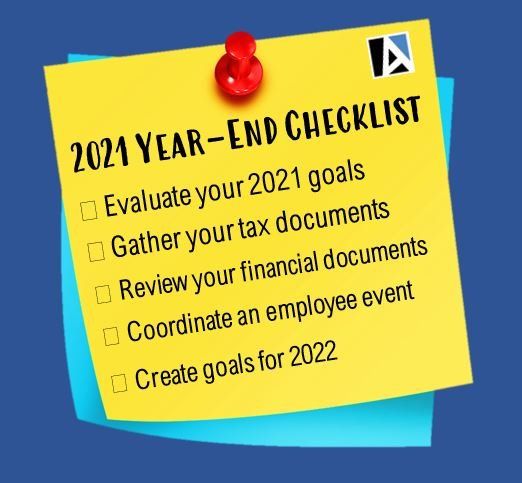

Year-End Checklist For Small Business Owners

The end of the year can be hectic with business planning that needs to be done to wind down with 2021 and plan for 2022. In this week's newsletter, I have noted a series of tasks you need to complete before 2022 approaches.

Evaluate 2021 Goals:

Whether you have a physical list or have your goals memorized in your head, it is best to write down each one to go over it at the end of the year. Review and assess each of your goals by asking yourself why or why weren't your goals achieved in 2021, what next steps can you take to exceed the goals you fell short on, or how did you exceed the goals you achieved. Every goal you have requires different type of attention and evaluations to make sure you are moving in the right path. It is crucial that business owners evaluate their progress to figure out if they are on the right path or if any adjustments need to be made.

Gather your tax documents:

Year-end isn't considered tax season, however you will benefit from staying ahead with your tax planning. Organized tax records make preparing an accurate tax return easier and helps you to avoid errors or overlook deductions or credits. The financial reports you prepare will help you fill out your 2021 business return in 2022.

Wait to file until you have your tax records including:

- Forms W-2 from your employer(s)

- Forms 1099 from banks, issuing agencies and other payers including unemployment compensation , dividends , distributions from a pension, annuity or retirement plan

- Form 1099-K , 1099-MISC , W-2 or other income statement if you worked in the gig economy

- Form 1099-INT if you were paid interest

- Other income documents and records of virtual currency transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance Premium Tax Credits for Marketplace coverage

- Letter 6419, 2021 Total Advance Child Tax Credit Payments to reconcile your advance Child Tax Credit payments

- Letter 6475, Your 2021 Economic Impact Payment, to determine whether you're eligible to claim the Recovery Rebate Credit

Review your financial documents:

Reviewing your financial documents plays a crucial role in your business. Financial statements are a lifeline for your business and help you understand your financial standing and (hopefully) make tax season less of a burden on you.

The financial documents you need before year-end are:

The balance sheet reportYour balance sheet shows your assets, liabilities, and equity to track your business's financial progress. Your liabilities and equity should ALWAYS equal your assets. Using the balance sheet with ensure your accounts are balanced and everything is in order for the new year.

The income statement report

Your income statement, or P&L statement, summarizes your revenue and expenses. What you will see on your P&L statement is revenue, tax expenses, operating expenses, cost of goods sold, depreciation, earnings before interest, taxes, depreciation, and amoritzation. Compare your income statements from this year (2021) and the previous year (2020) to analyze the differences in revenue and expenses.

The cash flow statement report

Your cash flow statement lists the incoming and outgoing cash. This report shows you which months have a higher cash flow and the months where your business is struggling. Tracking your cash flow throughout the year and at year-end can also help you create a cash flow forecast and predict future cash flow.

Be sure to ask your accountant or CPA if they can put these forms together for you!

Below are additional year-end tasks to be completed before year end:

Coordinate an employee event:

Employees are an important ingredient to the success of your business. Year-end is the perfect time to throw a holiday party which will provide you multiple opportunities to reward them for what they’ve done during the year. It is critical for us to celebrate our employees because connection, celebration, and appreciation build better working teams and strengthen our team bond. As business owners, we should want to encourage and empower our staff for all they've accomplished this previous year.

If throwing a celebration isn't your speed, instead of hosting an event, you can give your team additional time off to spend with their families for the holidays.

Create goals for 2022:

Creating new, challenging, and attainable goals can be overwhelming because some may take a lot of work to achieve.With your business needs and goals clearly visible from assessing 2021, your planning for this year will be less time-consuming and well thought out. Once you create your goals, develop a solid plan to take action to reach your goal.

If you need ideas for what type of goals you can create for the new year, you can start with the key points below.

Financial Goals

*Sign up for credit monitoring or identity theft protection

*Pay off a credit card

*Create a budget

*Save more

*Check credit score more often

*Improve credit score

Career Oriented Goals:

*Learn a new skill

*Measure your work-life balance

*Review and improve your LinkedIn profile

*Find a work mentor

*Take a new professional headshot

Health Goals

*Cut back on sweetened beverages

*Get more quality sleep

*Find a physical activity that you enjoy

*Take more "me time" and practice self-care

*Limit screen time

*Visit your doctor and dentist

Personal Goals

*

Pick up a hobby

*Learn something new each day

*Read more books

*Be more grateful

*Spend more time in nature

*Bring more peace into your life

*Keep a journal

*Volunteer

Things to do at the beginning of the new year:

- Check whether any payroll rates have changed.

- Verify that your payroll reflects the most current unemployment rate and that your pay is in line with current minimum wage law.

- Update service account passwords and who has access to them.

- Update any changed policies and procedures.

- Reorganize files and your email inbox (groan, we know)

- Fill out a business calendar. Add in due dates for bills and taxes so that you don't fall behind.