Fill out our short questionnaire to see

if we are a good fit!

If you did not read part 1and 2 that explains how our spending is tied to our behavior, go back and read them here: ( http://adminbooks.sitemodify.com/a-big-ol-glob-of-toothpaste-part-2 )

I recently read the book, Profit First by Mike Michalowicz. I met Mike at a QuickBooks Conference in San Jose, CA. While his book has many golden chunks, he is hilarious in person and his book on audible was the most entertaining book I have ever “read”.

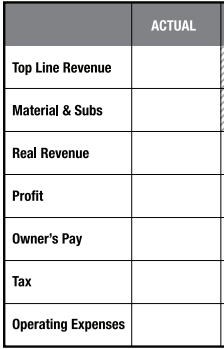

Instant Assessment: Take a snapshot of your business. Fill in the actual percentages of the last 12 months. Calculate the current allocation percentages and work towards the target allocation percentages adjusting them each quarter. If you are adjusting conservatively, Mike recommends 3% each quarter.

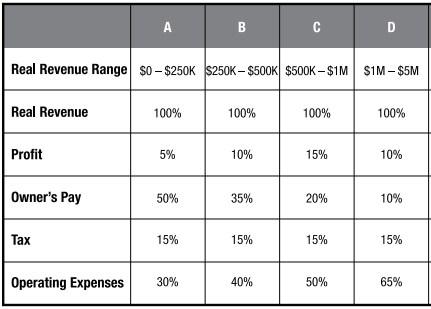

Now that you know your current percentages, figure the target percentages you need to work towards:

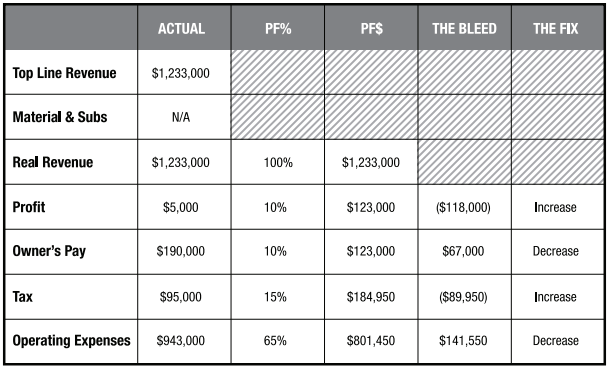

Here is an example of a completed assessment:

To change the percentages, you need to either increase income or decrease expenses. Increasing income does not happen overnight. Start with new clients. Increase current client rates 5%, which is a small amount to them, but a big help to your bottom line. If you are overspending in the operating bucket, business owners can easily cut expenses on frivolous items by 10% to 15% off the top. Find innovative ways to get the same or better results with less. Diving deeper into the operating costs may feel like squeezing a near-empty tube of toothpaste!

Transfer funds twice a month on the 10th and the 25th. Take a profit distribution every quarter. Every quarter you will also pay your estimated tax payments.

If you want to get out of debt, you must get more enjoyment out of saving than you do spending. It is a game of emotion. When in debt, use 99% of your profit allocation toward wiping it out. Use 1% to celebrate. Set up a debt snowball to pay off loans.

Running the assessment is easy, Mike says. Facing the truth about your business financials is right up there with root canals and colonoscopies.