Fill out our short questionnaire to see

if we are a good fit!

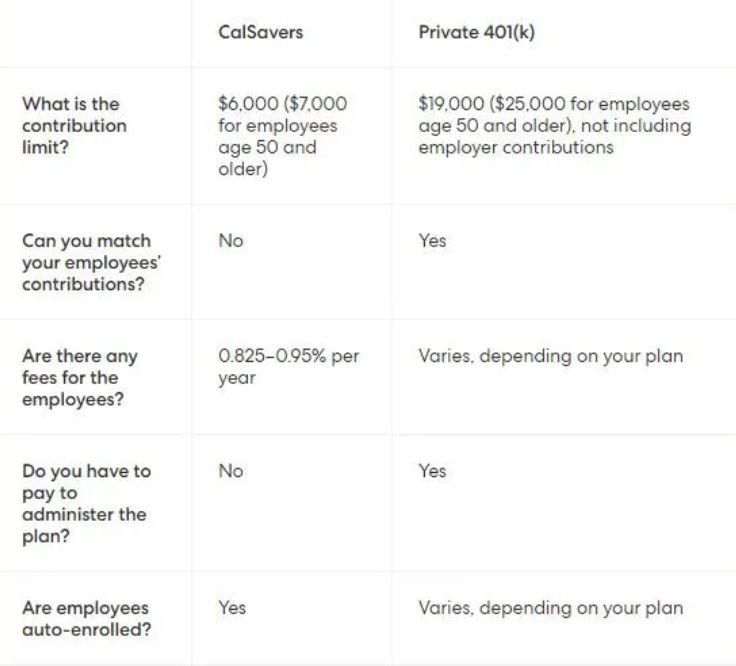

A state sponsored program has been developed called CalSavers, a Roth IRA, that will provide millions of workers a chance to save retirement funds for their future. If employers do not already have a qualified plan in place, they will have to implement CalSavers, or another retirement plan, prior to the deadlines stated above.

It is recommended to explore all available options to you and your business before committing to a retirement plan.

Below are commonly asked question and helpful links from Paychex and Gusto with more information such as:

CalSavers is a Roth individual retirement account (IRA) that is designed to give millions of workers in the State of California who lack access to an employer-sponsored qualified retirement plan, a chance to save for the future. CalSavers also will offer traditional IRAs. The difference between the two: Roth IRAs invest post-taxed earnings and withdrawals aren't taxed, while traditional IRAs invest pre-tax earnings and withdrawals will be taxed as income.

If you have 5 or more employees, the law requires you to either offer a qualified retirement plan through the private market, or give your employees access to the CalSavers program by the deadlines listed above.

If you already offer a retirement plan. you don't need to sign up for CalSavers. However, you do need to certify your exemption, which can be done online through the CalSavers website.

If you plan to use CalSavers, instead of a private market option, you’ll start by registering your business on the CalSavers website. (You’ll start on the same screen as employers who are certifying their exemptions.)

As the employer, you won’t have to spend anything—CalSavers is entirely free for you to use.

However, your employees will have to pay an administration fee, taken from the assets in their accounts. Depending on the investment program they choose, they will pay an annual fee of between 0.825 and 0.95%.

If your company already sponsors an eligible retirement plan, you can file for exemption here: Click Here to Report an Exemption .

Please keep in mind that through CalSavers, employers cannot make contributions on behalf of their employees. If an employer wishes to make contributions or match, they will need to explore other retirement plans.

Notify payroll of any deductions that need to take place on employees payroll checks. The employer will be responsible for remitting the contributions to CalSavers after each pay period according to the deductions that took place on employee’s paychecks. These reports can be provided to you from the payroll department.

Resources :

Paychex Worx CalSavers Article

Gusto CalSavers Article

CA Treasurer - CalSavers Index

The official link to the CalSavers website is: https://www.calsavers.com/